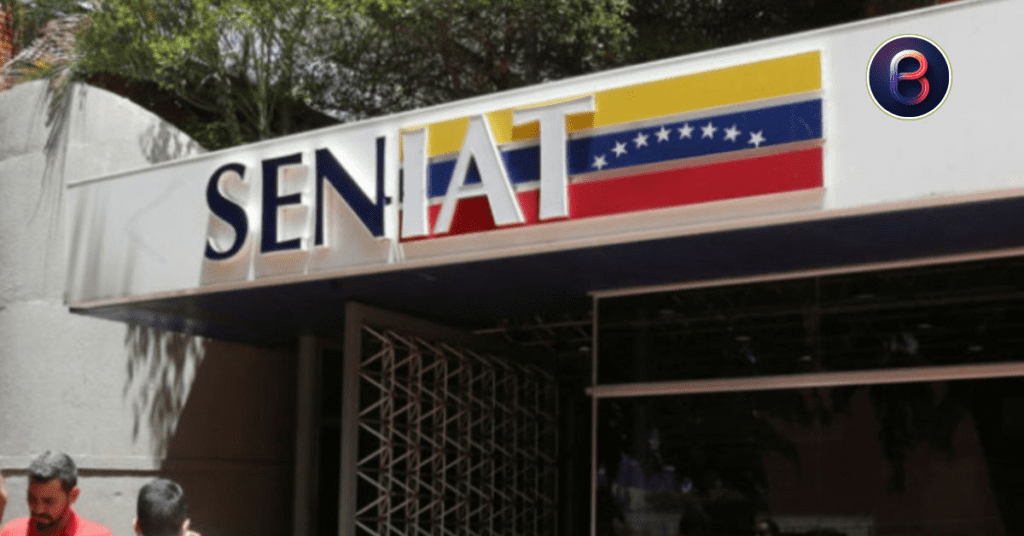

If you live in Venezuela, you’ve probably heard of the SENIAT consulta de RIF. But what exactly is it, and why is it important? The RIF, or Registro de Información Fiscal, is a tax identification number that everyone needs, whether you’re an individual or running a business. Checking your RIF regularly helps you stay out of trouble with the government and ensures your information is correct. In this blog, we’ll guide you through everything you need to know about SENIAT RIF consultation, making it easy for you to manage your taxes and stay informed!

Why Consult Your RIF?

Consulting your RIF is important for several reasons. First, it helps you ensure your information is accurate and up-to-date. This can prevent problems with taxes and fines. Regular checks can reveal issues, like mistakes in your records, that you can fix before they become big problems. By staying on top of your SENIAT consulta de RIF, you protect yourself and your finances!

Benefits of Regular RIF Consultation

- Avoiding Penalties: If your information is incorrect, you may face fines. Regularly checking your RIF helps avoid this.

- Financial Planning: Knowing your tax status helps you plan better financially, especially if you run a business.

- Peace of Mind: Regular checks provide reassurance that your tax affairs are in order.

Understanding RIF (Registro de Información Fiscal)

What is RIF?

The RIF, or Registro de Información Fiscal, is a unique tax identification number assigned by SENIAT to individuals and businesses in Venezuela. It’s like your personal ID but for taxes! It helps the government keep track of who pays taxes and how much. Without a RIF, you may have trouble accessing certain services or conducting business legally.

Also, read more

The Ultimate Guide to Federal Inmate Text Messaging 2024

Who Needs a RIF?

Everyone in Venezuela who earns money or runs a business needs a RIF. This includes:

- Employees: Every working individual must have one for tax purposes.

- Freelancers: Independent workers must register to pay taxes correctly.

- Small Business Owners: Even if you just sell goods occasionally, a RIF is essential.

Common Misconceptions About RIF

Many people think that only big companies need a RIF. This isn’t true! Even small businesses and individuals need one. Understanding this can help avoid confusion and ensure everyone stays compliant with tax laws.

How to Perform a SENIAT Consulta de RIF

Step-by-Step Guide

- Go to the SENIAT website: Start by visiting the official SENIAT website.

- Look for the option for RIF consultation: This is usually located in the main menu or under the services section.

- Enter the required information: Input your ID number and any other requested details.

- Click “Submit”: After entering your information, click the button to view your details.

Tips for Successful Consultation

- Double-Check Your Information: Ensure you enter your ID correctly to avoid errors.

- Keep Records: Take screenshots of your results for future reference.

- Contact Support: If you encounter any issues, reach out to SENIAT’s support team for help.

FAQs about SENIAT consulta de RIF

¿Cómo consultar el RIF en el SENIAT?

Visita el sitio web de SENIAT, busca “Consulta de RIF”, ingresa tu cédula y haz clic en “Enviar”.

¿Cómo sacar el RIF en línea?

Accede al sitio de SENIAT, completa el formulario de solicitud de RIF con tu cédula y sigue las instrucciones.

¿Cómo actualizar el RIF solo con la cédula?

En el portal de SENIAT, ve a “Actualización de RIF”, ingresa tu cédula y sigue los pasos para actualizar tu información.

¿Cómo obtener el comprobante del RIF?

Ingresa al sitio de SENIAT, selecciona “Descargar Comprobante de RIF”, ingresa tu información y descarga el comprobante.

What if I don’t have a RIF?

If you don’t have a RIF, don’t worry! You can apply for one on the SENIAT website. Just follow their guidelines, which include providing necessary identification and filling out forms.

Additional Resources

Useful Links

- SENIAT Official Website: Your go-to place for everything related to taxes.

- Other Helpful Government Resources: Look for additional sites that offer advice on taxes and compliance.

Tools and Apps for RIF Management

Consider using tax management apps that help you track your RIF and remind you of important deadlines. These tools can simplify your tax experience by offering features like:

- Expense tracking: Monitor your expenses throughout the year.

- Deadline reminders: Get alerts for upcoming tax deadlines.

Conclusion

In summary, regularly consulting your RIF is essential for staying informed and compliant with Venezuelan tax laws. By checking your SENIAT consulta de RIF, you can avoid problems and ensure everything is in order. Remember, it’s better to stay proactive about your taxes!

Share Your Experience

Have you checked your RIF lately? Share your experiences or questions in the comments below! Let’s help each other stay informed about the SENIAT consulta de RIF process. Don’t forget to share this blog with your friends who might need this information!